Income simulator for employees 01/2026

You'll find this simulation and other tools to help you set up and run your business on mon-entreprise.urssaf.fr .

This simulation was carried out on 3/5/2026.

Before we begin...

The simulator does not currently take into account collective agreements, nor the myriad of company subsidies. Find your collective bargaining agreement here , and explore the range of assistance available on aides-entreprises.fr .

The calculations are indicative. They are based on the information you have entered and the applicable regulations, but they do not take into account your entire situation. They are not a substitute for actual statements from Urssaf, the tax authorities or any other organization.

The simulator does not currently take into account collective agreements, nor the myriad of company subsidies. Find your collective bargaining agreement here , and explore the range of assistance available on aides-entreprises.fr .

The calculations are indicative. They are based on the information you have entered and the applicable regulations, but they do not take into account your entire situation. They are not a substitute for actual statements from Urssaf, the tax authorities or any other organization.

Simulation data is automatically updated when you modify a field. A panel will open to allow you to add details to the simulation, and detailed results will be displayed below the form and updated when you modify it.

Spent by the company

Gross reference (without bonuses, allowances or increases)

Net salary before tax

The net salary paid

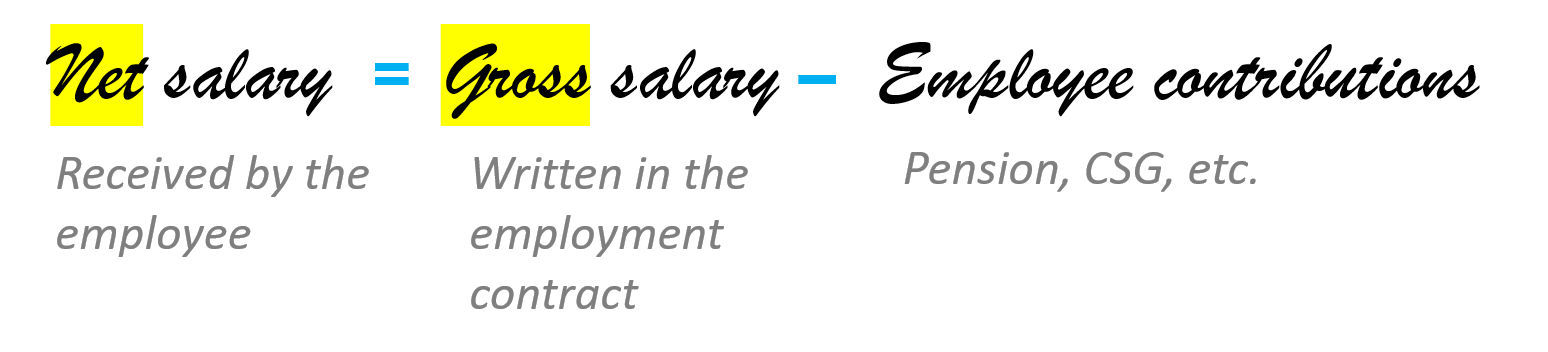

How do you calculate net salary?

During the job interview, the employer generally proposes a gross salary. This amount includes the employee's social security contributions, which are deducted from the "net" salary received by the employee.

You can use our simulator to convert gross pay into net pay: simply enter the pay advertised in the gross pay box. The simulation can be refined by answering the various questions (fixed-term contract, executive status, overtime, part-time work, meal vouchers, etc.).

In addition, since 2019,income tax has been deducted at source. To do this, the Direction Générale des Finances Publiques (DGFiP) sends the employer the tax rate calculated from the employee's tax return. If the employee's tax rate is unknown, for example in the first year of employment, the employer uses the neutral rate .

How do I calculate the cost of hiring?

If you're looking to hire, you can calculate the total cost of remunerating your employee, as well as the corresponding employer and employee contributions. This will enable you to define the level of remuneration, knowing the overall cost to your company.

In addition to salary, our simulator takes into account the calculation of benefits in kind (telephone, company car, etc.), as well as compulsory health insurance.

There are also deferred hiring subsidies which are not all taken into account by our simulator. You can find them on the official portal .

Talk to an advisor about your recruitment project

You would like to :

- be advised on the hiring aids available for your recruitment project

- Find out about apprenticeships, professionalization contracts, "emplois francs" in priority neighborhoods, VTE, etc.

- Find candidates

- Recruiting a disabled person

Fast, simple public service: you'll be called back by the advisor who can help you.

Partners: France Travail, Apec, Cap Emploi, local missions...

Useful resources

Partial activity

Calculation of the employee's net income and the employer's remaining costs after government reimbursement, taking into account all social security contributions.

Access the simulatorDigital labor code

For all your labor law questions, visit the Code du travail numérique website.

Read moreEmbaucher et gérer les salariés

De l’embauche d’un salarié jusqu’à la fin de la relation de travail, l’Urssaf vous accompagne dans vos démarches et formalités à accomplir.

Read moreNouvel employeur : l'Urssaf vous accompagne

Première embauche, un service de l’Urssaf pour guider les nouveaux employeurs dans leurs démarches.

Read moreIntegrate the web module

Find out how to add this simulator to your website in just one click via a turnkey script.

See the documentation